Managing money has always been an essential part of life, but in 2025, the way people handle their finances, budgets, and investments has changed dramatically. With rising living costs, digital payments, and increasingly complex financial products, individuals need tools that go beyond basic spreadsheets or simple calculators.

This is where finance and budgeting apps step in. In 2025, these apps are more powerful than ever, combining artificial intelligence, automation, blockchain technology, and real-time analytics to help people manage their money smarter. Whether it’s tracking expenses, setting saving goals, investing, or ensuring security, modern apps provide personalized solutions that adapt to different lifestyles and financial goals.

This article explores the top 10 finance and budgeting apps of 2025 that are redefining money management. Each one brings a unique strength—whether it’s AI-driven predictions, debt repayment tools, or multi-currency digital wallets. Together, they make financial literacy and control accessible to everyone.

1. Mint 2.0: Reinventing the Classic Budgeting App

For years, Mint has been a go-to budgeting app, but by 2025, Mint 2.0 has redefined itself with advanced automation.

What’s New

Mint 2.0 uses AI categorization to sort expenses instantly and offers predictive budgeting that helps users forecast future spending. The app also integrates with tax software, making year-end preparation seamless.

Why It Stands Out

The biggest strength of Mint 2.0 lies in its user-friendly design combined with deep financial insights. It’s ideal for beginners but also powerful enough for experienced users who want long-term financial planning.

2. YNAB (You Need A Budget) 2025: Goal-Driven Financial Discipline

YNAB continues to thrive in 2025 as a goal-oriented budgeting tool. Its method of assigning every dollar a purpose has helped millions gain financial discipline.

Modern Enhancements

The 2025 version integrates AI cash-flow forecasting and real-time financial coaching. If users fall off budget, YNAB provides instant suggestions to get back on track.

Who Benefits Most

YNAB 2025 is designed for people who want structure and accountability. It works well for families, freelancers, and anyone determined to achieve debt-free living.

3. PocketGuard 2025: The Simplified Budget Companion

For users who feel overwhelmed by detailed financial planning, PocketGuard 2025 simplifies everything.

Features in 2025

The app calculates “In My Pocket” money by subtracting bills, savings goals, and essentials from income. It now includes AI spending alerts that notify users before overspending occurs.

Why It Works

Its strength lies in its simplicity. By removing complexity, PocketGuard empowers users who want control without drowning in details.

4. Personal Capital NextGen: Wealth and Investment Focused

Personal Capital has always stood out by combining budgeting with wealth management. In 2025, the NextGen version brings even more tools for investors.

Key Capabilities

The app now supports crypto assets, fractional investing, and robo-advisory services. It provides holistic insights into retirement planning and long-term wealth building.

Value Proposition

It’s ideal for users who not only want to track expenses but also grow wealth strategically.

5. Goodbudget 2025: Digital Envelope System

The envelope system may sound old-fashioned, but in 2025, Goodbudget modernizes it digitally.

Modern Twist

Users can assign budgets into virtual envelopes for groceries, rent, entertainment, and more. The app now syncs seamlessly across households, making it useful for families.

Why It’s Effective

This method enforces intentional spending habits. For those who prefer a visual approach, Goodbudget remains a reliable companion.

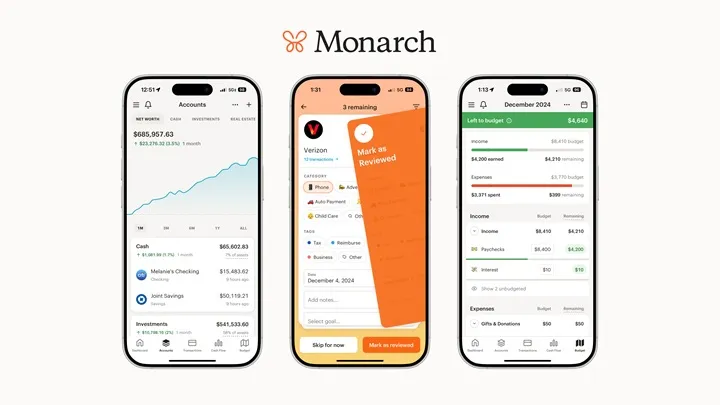

6. Monarch Money 2025: All-in-One Financial Hub

Monarch Money has emerged as a serious competitor in 2025, offering an all-in-one dashboard for financial management.

Notable Features

It consolidates bank accounts, investments, debts, and credit cards in one place. With AI-based recommendations, it suggests savings strategies and investment opportunities.

Who Uses It

Monarch Money appeals to users who want complete visibility into their financial health and appreciate modern, clean design.

7. Cleo 2025: AI Financial Assistant with Personality

Cleo continues to shine as an app that makes money management fun and engaging.

How It Works

The app uses AI chatbot features to analyze spending and provide witty, motivational nudges. It now includes advanced financial literacy coaching for younger audiences.

Why It Matters

By gamifying personal finance, Cleo reaches people who typically avoid traditional budgeting. It’s especially popular among Gen Z and young professionals.

8. Spendee 2025: Multi-Currency and Global Finance

As the world becomes more globalized, Spendee 2025 caters to users who manage money across countries.

Enhanced Capabilities

The app supports multi-currency wallets, crypto tracking, and family budget sharing. It also integrates with international banks for real-time updates.

Ideal Audience

Spendee is perfect for digital nomads, expatriates, and frequent travelers who need financial clarity across currencies.

9. Emma 2025: The Subscription Killer

Subscription fatigue has become a real financial issue. Emma 2025 specializes in identifying, managing, and canceling unused subscriptions.

Why It’s Unique

With AI-driven analysis, Emma predicts subscription renewals and recommends alternatives. It also tracks hidden fees that often go unnoticed.

Impact

By helping users cut wasteful spending, Emma has become a must-have app for modern households.

10. Zeta 2025: Finance for Couples and Families

Zeta 2025 is designed specifically for couples and families who want to manage shared finances.

Features

It allows joint accounts, bill-splitting, and goal tracking. By 2025, Zeta now includes relationship-based financial advice, helping couples align money with life goals.

Broader Relevance

With more families adopting shared budgeting apps, Zeta stands out as the leading platform for collaborative financial planning.

Conclusion

In 2025, finance and budgeting apps have evolved from simple expense trackers into powerful, AI-driven financial ecosystems. Whether it’s Mint 2.0’s automation, YNAB’s discipline, or Personal Capital’s wealth-building tools, these apps give users personalized control over their financial journeys.

From simplifying money management for beginners to offering advanced insights for investors, the top 10 apps of 2025 prove that financial literacy is no longer optional—it’s essential. With the right app, anyone can develop smarter habits, eliminate wasteful spending, and move closer to financial freedom.